Credit Risk Transfer Advisory: Strategy, Execution, and Operations

MF&Co offers a full suite of credit risk transfer advisory offerings that cater to suppliers/buyers of mortgage/consumer/commercial-related risk transfer products and investments.

Credit risk transfer advisory services are designed for a wide range of market participants, including:

-

Banks

-

Mortgage lenders/servicers/warehouse providers

-

Specialty finance companies

-

REITs

-

Insurance companies

-

Private equity firms

-

Fixed Income/equity asset managers

For Credit Risk Transfer Fixed Income and Equity Investors

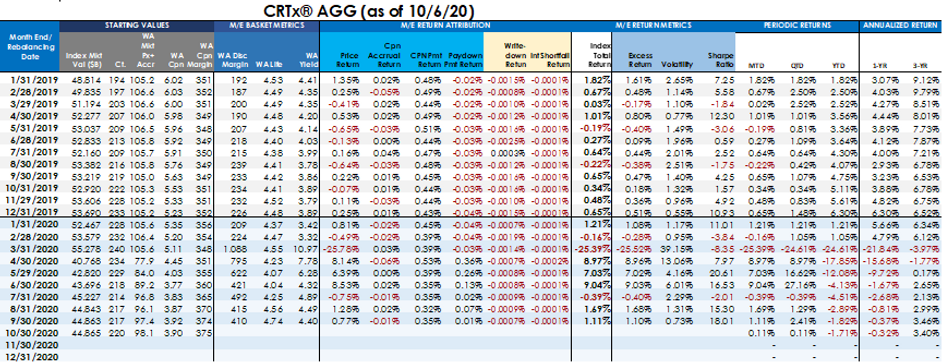

MF&Co Investment Characteristics Optimization (MICO™) Analytic Suite (powered by Bond Lab®)

-

MBS/RMBS/CRT Pool and Loan Level Cohort Analysis Tools

-

Mortgage OAS/Prepayment/Credit Risk Models

-

MBS/RMBS/CRT/Equity Human Intelligence Frameworks and Portfolio Management Analytic Tools for Risk/Reward Measurement, Evaluation, Projection, and Optimization:

-

MF&Co proprietary company/Investment risk and performance management evaluation framework:

.png)

For Credit Risk Transfer Issuers, Program Administrators, and Risk/Compliance Managers

Credit Risk Transfer Program Design, Structuring, Assessment/Evaluation, and Operational Readiness/Execution Planning or Testing

-

Approval, documentation, monitoring, compliance, and review process mapping and evaluation.

-

Complete transaction management process and documentation requirements development and/or review.

-

Evaluation of program risk/return estimates, hedging strategies, economic targets, methodologies, and models (including champion/challenger testing).

-

3rd-party performance monitoring, including independent market value opinions, benchmarking, cashflow calculation checks, and current/projected credit risk measurement.

Sample Risk Transfer Program Assessment Framework Schematic and Evaluation Outputs

-

MF&Co portfolio indexing/benchmarking engines: